The world needs a scalable clean energy solution. Our energy storage technology enables the widespread adoption of renewable energy while minimizing environmental impact and maximizing efficiency. Gravity Power holds 4 patents across 20 countries, has partnerships with global industry leaders, and is ready to move to commercialization in this $1 trillion market.

Raised 100 % of minimum

Funding Raised

$70,932

Funding Goal

$9,999.75-$999,999.75

Days Left to Invest

1 Days

Gravity Power

The world needs a scalable clean energy solution. Our energy storage technology enables the widespread adoption of renewable energy while minimizing environmental impact and maximizing efficiency. Gravity Power holds 4 patents across 20 countries, has partnerships with global industry leaders, and is ready to move to commercialization in this $1 trillion market.

Raised 100 % of minimum

Funding Raised

$70,932

Funding Goal

$9,999.75-$999,999.75

Days Remaining

1 Days

Business Description

REASONS TO INVEST

REASONS TO INVEST

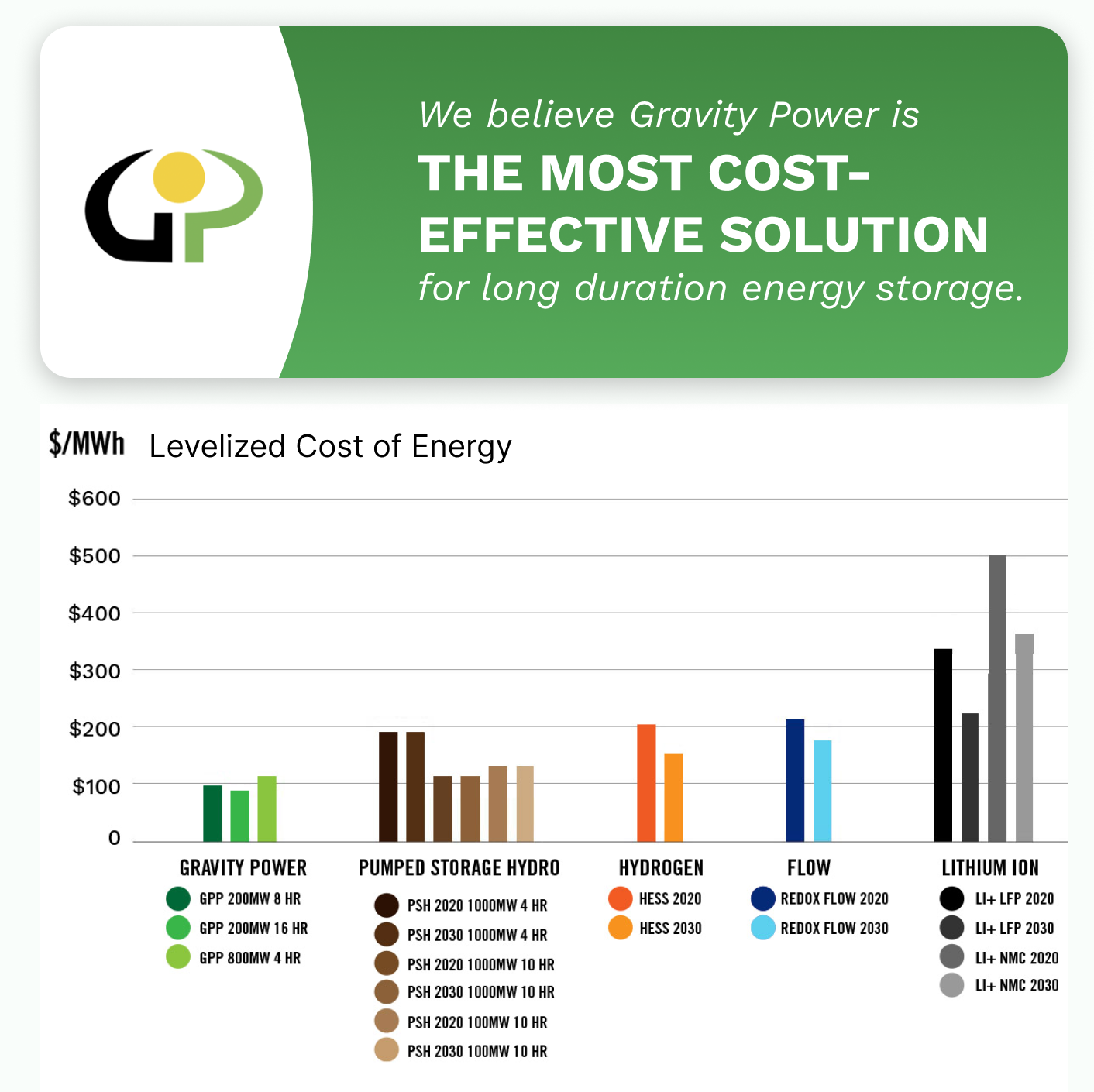

1. INNOVATIVE TECHNOLOGY: Our energy storage technology lowers levelized costs and minimizes environmental impacts, leveraging existing fossil fuel industry infrastructure for a cleaner future.

2. INDUSTRY RELATIONSHIPS: We have key relationships with industry leaders including Stantec, the Robbins Company, and Computerized Analysis & Simulation Ltd to move our product toward commercialization.

3. EXPERIENCED LEADERSHIP: We are led by a team of experts with decades of experience as innovators in clean energy, engineering, and entrepreneurship.

THE PITCH

The world needs a scalable clean energy solution. Our energy storage technology enables the widespread adoption of renewable energy while minimizing environmental impact and maximizing efficiency. Gravity Power holds 4 patents across 20 countries, has partnerships with global industry leaders, and is ready to move to commercialization in this $1 trillion market.

OVERVIEW

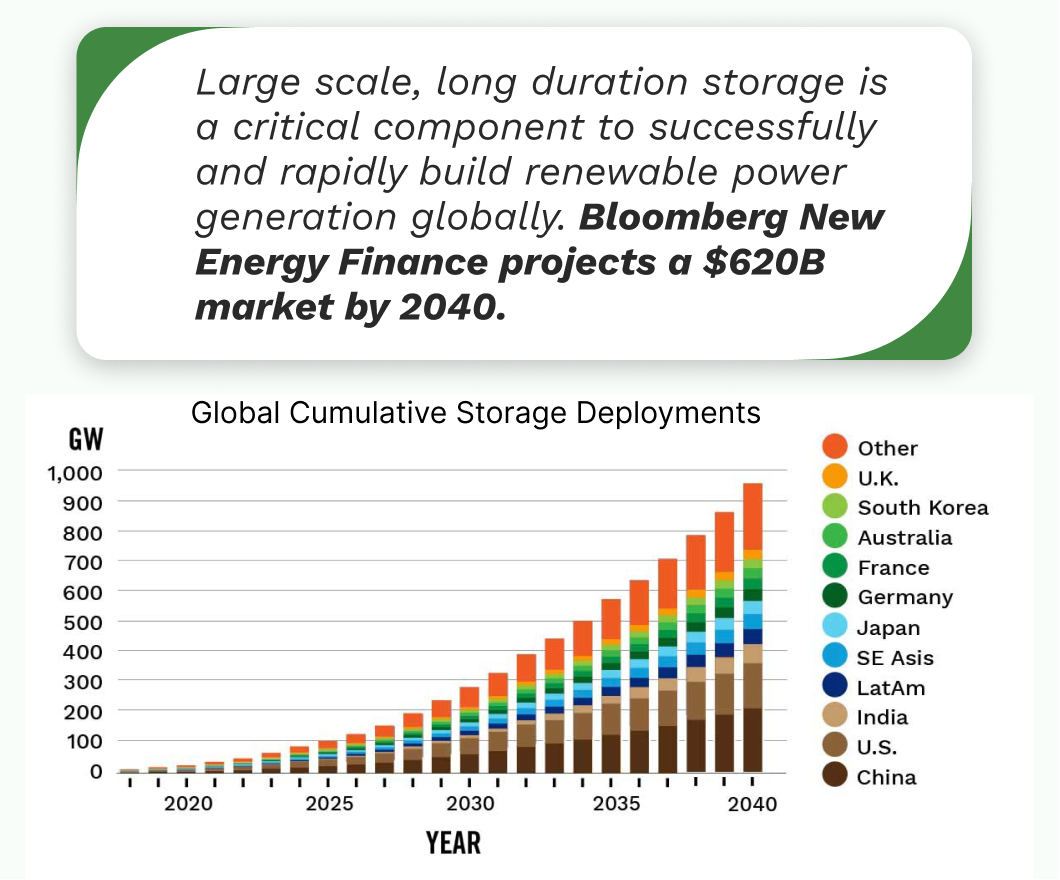

Scalable Energy Storage Critical to Stopping Climate Change

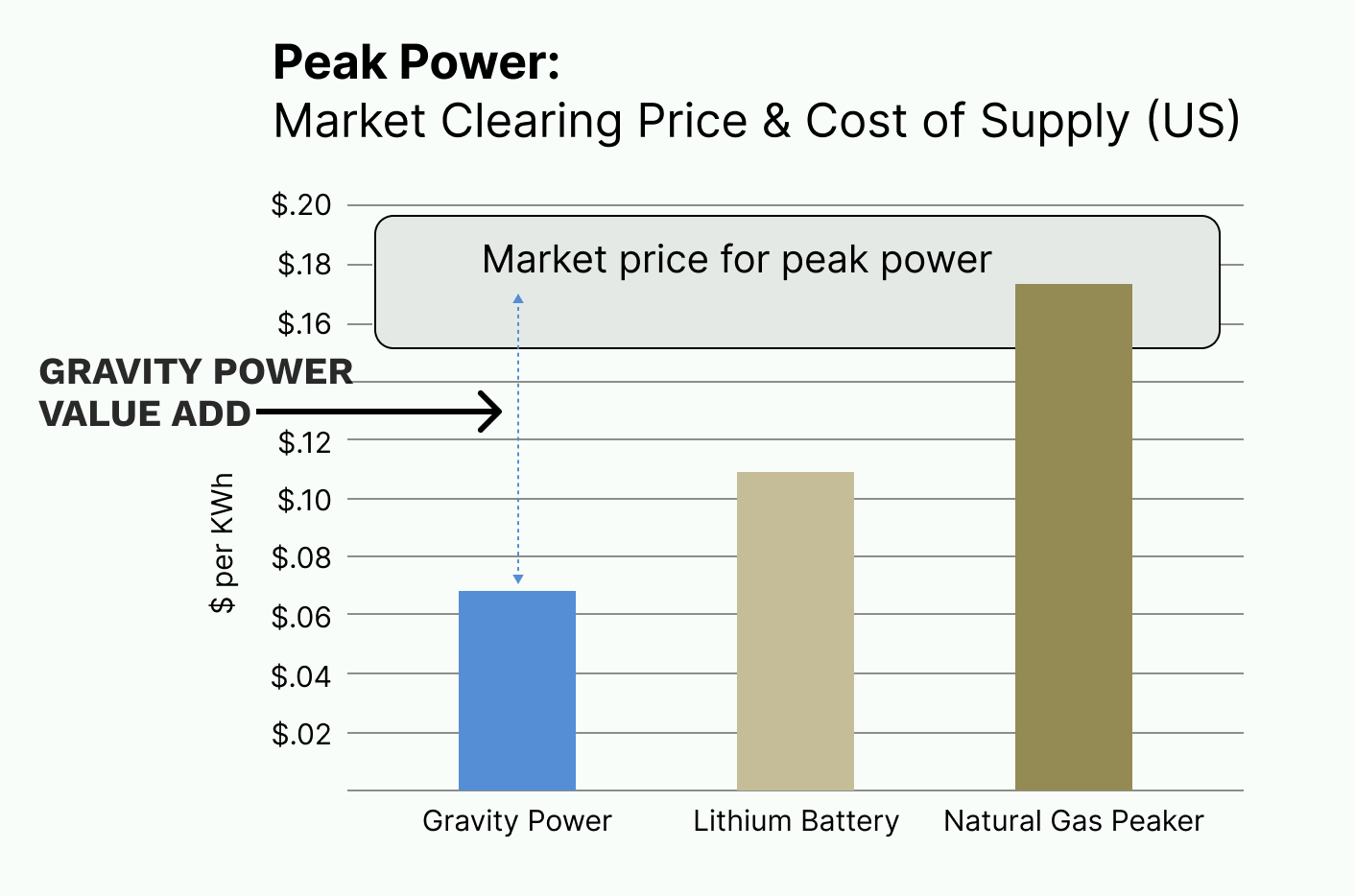

We are designing Gravity Power plants to turn unpredictable, renewable energy into reliable peak-period power. We believe that once commercialized, we can increase the value of renewable energy from 3-6 cents (for “as-available” renewable energy or for “based load” resources) to 15-20 cents per KWh. With pumped storage unable to meet the global need for energy storage globally, we are ready to meet the $1 trillion demand for energy storage with highly efficient and eco-friendly technology. Join us as we build the future of clean energy.

Gravity Power infomercial to air on CNBC at 11PM PDT April 6, 2024

Problem

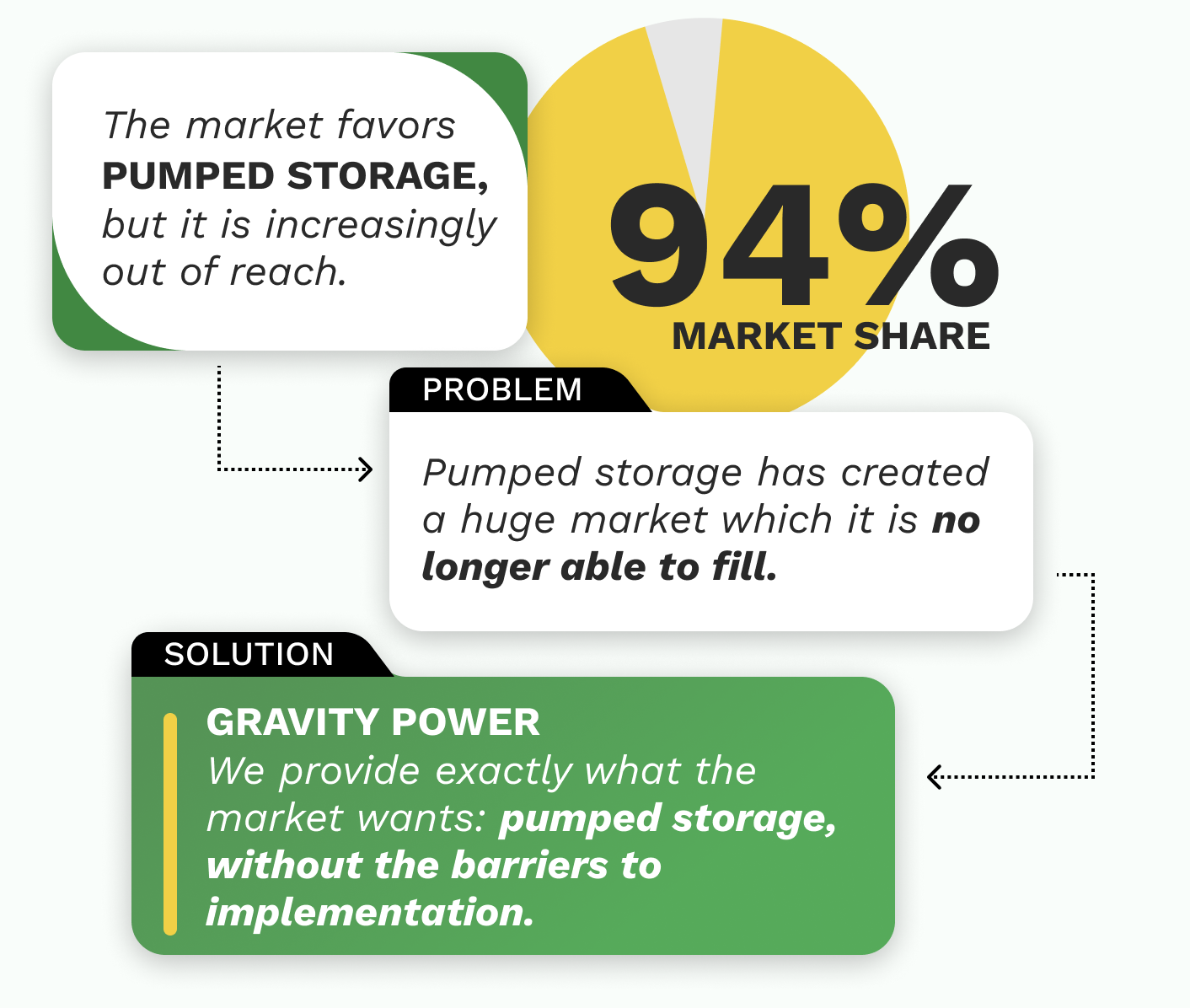

Currently, pumped storage hydroelectric dominates the energy storage market, with 94% of the market. However, pump storage is increasingly out of reach for customers, as it is difficult and time-consuming to deploy, while being land inefficient and environmentally controversial. As a result, pumped storage is not being adopted at the necessary scale to meet the markets need and “decarbonize” the electric grid.

Solution

Efficient, Eco-Friendly, and Easily Executed

We are meeting the market demand for energy storage with technology, that lowers costs, raises efficiency and minimize environmental impacts. Gravity power makes it straightforward to obtain permits and sites, delivering the same compelling customer value proposition as pump storage being highly scaled for adoption.

Business Model

Gravity Power’s business model is projected to consist of licensing the technology and offering technical support focused on electric load-serving entities, independent power producers, transmission companies, and similar entities.

We intend to offer our technology across the globe through direct-to-business channels and through intermediaries, such as engineering companies. The Company believes that it is a favorable investment because of unbeatable customer value (we have what we believe is the only storage tech that is low-levelized cost, environmentally benign, high efficiency, and straightforward to site), broad patent protection (4 patents in 20 countries), an active investment climate for energy storage, and an attractive share price.

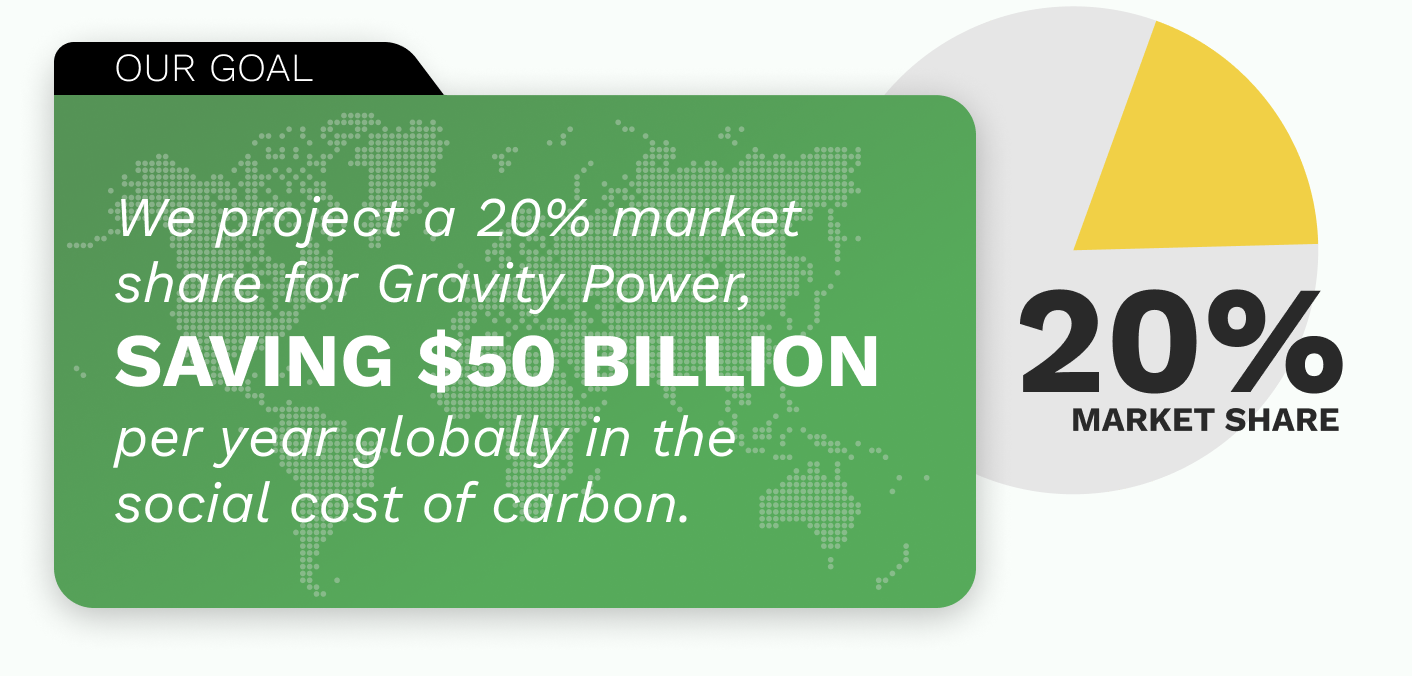

Market Projection

The Demand for energy storage is projected to be over $1 trillion, driven primarily by the rapidly worsening climate crisis. The recently passed by parts and infrastructure wall contains $505 million in funding to support the development and deployment of energy storage technologies.

Competition

The dominant legacy technology is pumped storage hydroelectric (PSH), with a 94% global market share. PSH offers lowlevelized cost, high efficiency, reliability, and grid stabilization, but it is environmentally damaging and controversial. As a result, PSH projects typically take a decade or more to secure approvals, and many are simply abandoned in the face of public opposition.

Lithium-ion batteries have gained some market share, but they are also environmentally damaging and too expensive for grid-connected energy storage at scale. Other technologies in the market or in the technology pipeline include chemical batteries, compressed air, flow, mechanical lifting of weights, hydrogen, thermal, Energy Vault, HydroStore, Gravitricity, et al). We believe none appears to us to offer the compelling value proposition that Gravity Power does.

Traction & Customers

Strong Partnerships in a Fast-Growing Industry

We have formed the strategic partnerships with companies, such as Stantec, One of the top 10 engineering firms worldwide. Our technology has been verified by numerous third-party experts, including Stantec, BabEng, and Hochtief. Most recently, we have agreed to conduct a joint R&D program with the Robbins Company, The pioneer of the tunnel boring machine.

Patents

Gravity Power holds 4 key, competition-blocking patents on this technology, in 20 countries. Energy storage is essential to decarbonizing the grid; Gravity Power believes that it can capture much of the global market, estimated to be $1 trillion by 2040, and make a sizable dent in climate change, all with a potentially capital-efficient, lucrative business model.

Investors

The issuer conducted their first exempt crowd-funding offering ending on December 11, 2023 through StartEngine. They raised $232,624.69 through the end of the offering. The net proceeds are being used for R&D and operational purposes.

Terms

Gravity Power Inc. is offering securities in the form of Equity which provides investors the right to Preferred B-2 Stock in the Company.

Target Offering: $9,999.75 | 13,333 Securities

Maximum Offering Amount: $999,999.75 | 1,333,333 Securities

Share Price: $0.75

Type of Offering: Equity

Type of Security: Preferred B-2 Stock

Offering Deadline: April 28, 2024

Minimum Investment: $249.75

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $249.75. The Company must reach its Target Offering Amount of $9,999.75 by April 28, 2024 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $9,999.75 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Equity Security

Price Per Share

$0.75

Shares For Sale

1,333,333

Post Money Valuation:

$25,496,380.5

Investment Bonuses!

Time-Based Incentives (Awarded at Checkout):

Very Super Early Bird Bonus: Invest at least $249.75 by April 6, 2024, and receive a 37.5% discount on shares.

Super Early Bird Bonus: Invest at least $249.75 by April 14, 2024, and receive a 28.5% discount on shares.

Early Bird Bonus: Invest at least $249.75 by April 21, 2024, and receive a 16.5% discount on shares.

Last Chance Bonus: Invest at least $249.75 by April 28, 2024, and receive a 9.0% discount on shares.

Amount-Based Incentives (Awarded After Raise):

Invest $500+ and receive 5% Bonus Shares.

Invest $1,000+ and receive 10% Bonus Shares.

Invest $2,500+ and receive 15% Bonus Shares.

Invest $5,000+ and receive 20% Bonus Shares.

Invest $10,000+ and receive 30% Bonus Shares.

Invest $20,000+ and receive 35% Bonus Shares.

Invest $30,000+ and receive 40% Bonus Shares.

Invest $40,000+ and receive 50% Bonus Shares.

*Investors can receive one (1) time-based incentive and one (1) amount-based incentive per investment.

**In order to receive perks from an investment, one must submit a single investment in the same offering that meets the minimum perk requirement. Bonus shares from perks will not be granted if an investor submits multiple investments that, when combined, meet the perk requirement. All perks occur when the offering is completed.

***Crowdfunding investments made through a self-directed IRA cannot receive non-bonus share perks due to tax laws. The Internal Revenue Service (IRS) prohibits self-dealing transactions in which the investor receives an immediate, personal financial gain on investments owned by their retirement account. As a result, an investor must refuse those non-bonus share perks because they would be receiving a benefit from their IRA account.

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

April 29, 2024

Minimum Investment Amount:

$249.75

Target Offering Range:

$9,999.75-$999,999.75

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

Steve Taber

Chairman & CEO

BackgroundA leading developer of energy efficiency and renewable energy projects throughout the world. Led the industry in numerous areas of innovation, including business models, renewable energy technologies, and financing techniques.

Robert B. Weisenmiller, Ph.D.

Director

BackgroundFormer Chair of the California Energy Commission and one of the world’s leading voices on energy. Helped shape California’s pioneering energy policies, Co-founded and managed MRW & Associates, to assist organizations in strategic planning, policy development, energy market analysis and regulation, power pricing for qualifying facility projects, marginal cost analysis, rate design, and implication of utility mergers.

Jim Fiske

CTO

BackgroundExperienced in digital image processing hardware design, digital electronics, computer design, CAD software development, electro-mechanical system design, maglev transportation, energy storage, and low-cost space launch.

Thomas Mason

Board Member

BackgroundPresident of CalEnergy in mid 1990s and EVP of Calpine Corp and President of Calpine Power Company from 1999 to 2006. Constructed and acquired power plants through that period, operating 92 gas fired and geothermal power plants in 2006.

Globally Recognized Experts

Advisory Board

BackgroundGravity Power has also built a strong advisory board, including globally recognized experts in energy markets, regulatory policies, control theory, system analysis, generation scheduling and control, power grid control, hydroelectric systems engineering, underground engineering and construction, and sealing technologies.

Legal Company Name

Gravity Power

Location

945 Ward Drive

#28

Santa Barbara, California 93101

Number of Employees

3

Incorporation Type

C-Corp

State of Incorporation

DE

Date Founded

July 21, 2023

Raises half the minimum amount

Gravity Power has raised half of the target offering amount on March 26, 2024. $40,803 has been raised at this time.

Raises 100% of the minimum amount

Gravity Power has raised the target offering amount on March 26, 2024. $40,803 has been raised at this time.Investors should be aware that the Issuer can now conduct rolling closes if they wish. If the Issuer decides to do so, you will be notified and given time to cancel your investment.